Key features

Comprehensive protection for 81 critical illnesses

Cover 81 critical illnesses

Reimbursing cancer drug expenses

10% of sum insured

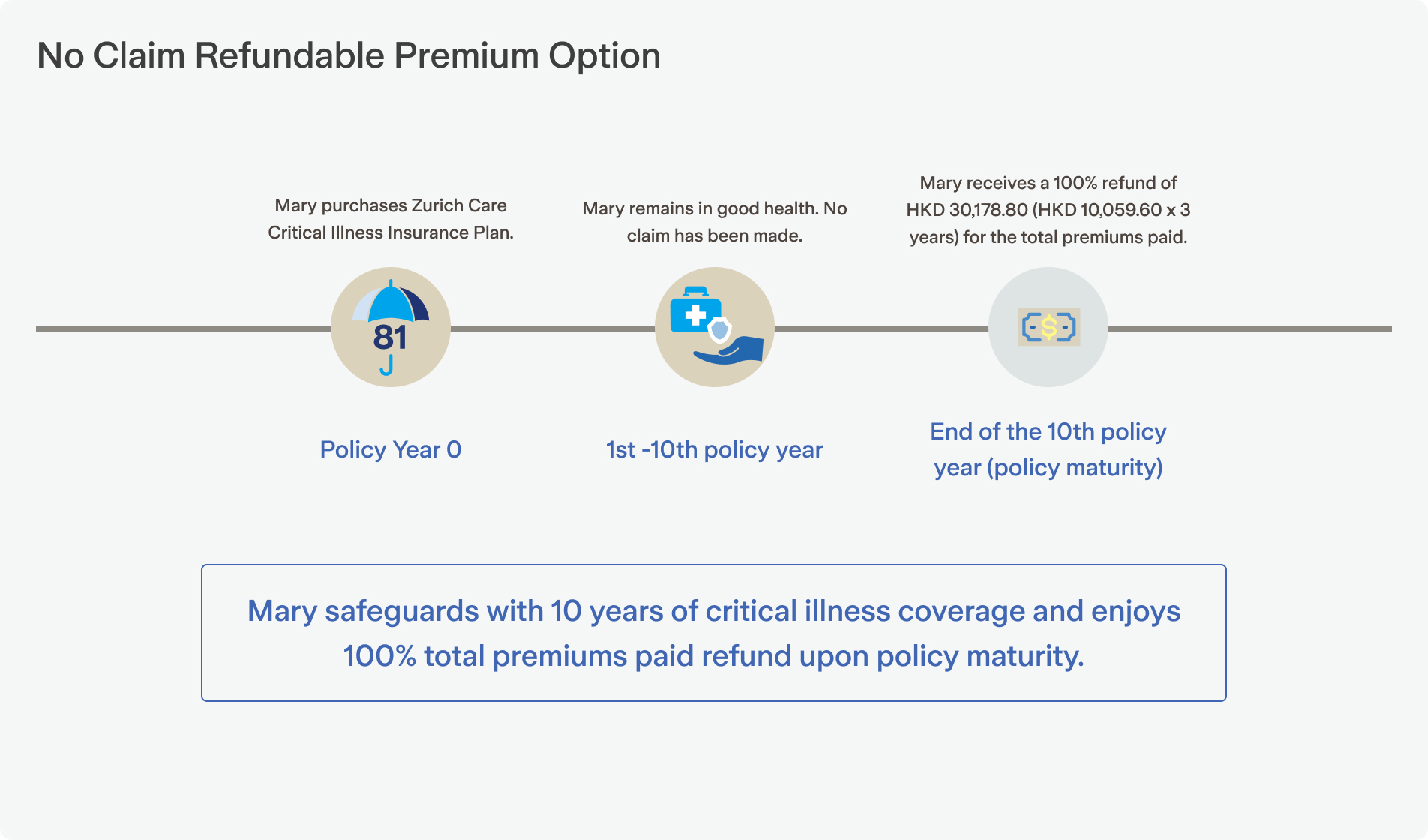

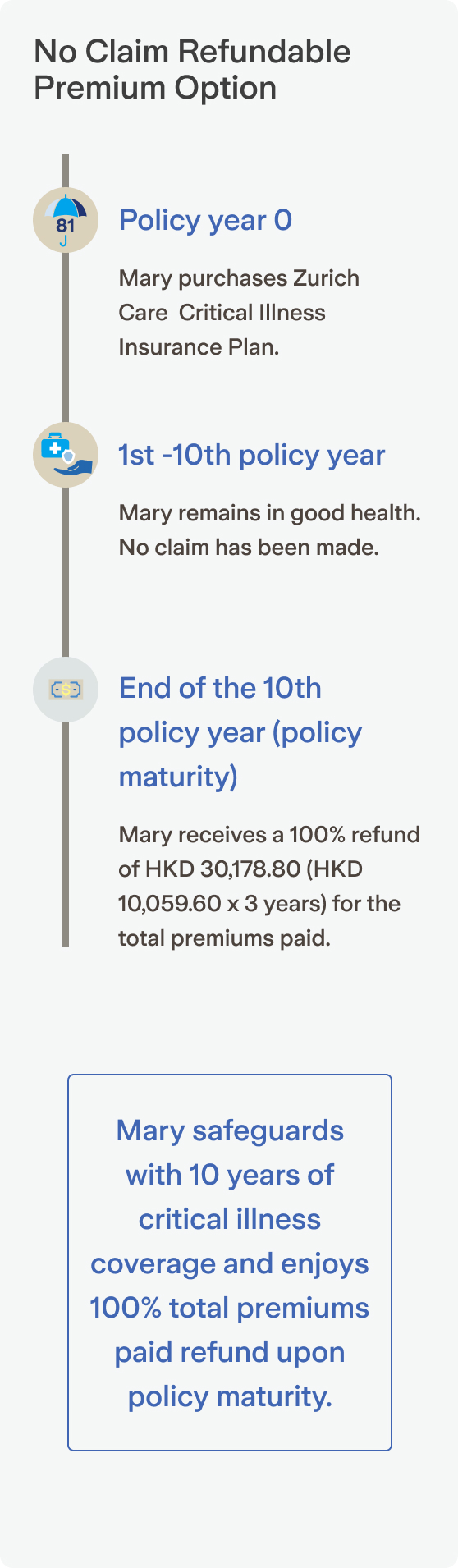

100% premium refund – applicable to No Claim Refundable Premium Option

Receive 100% premium refund upon policy maturity if no claim has been made

Extra aid for stay in Intensive Care Unit (ICU)2

Cover known/unknown diseases or injuries

Nominating contingent policyholder for your peace of mind

Aid you in processing a claim if the policyholder suffers from specified disability3

No survival period

Unlike some critical illness plans in the market, our plan does not have survival period that the life insured must live for certain period after being diagnosed with a critical illness.

Which option should I choose?

|

No Claim Refundable Premium Option |

Non-Refundable Premium Option |

|

|---|---|---|

|

Covered 81 critical illnesses and cancer drug benefit |

|

|

|

Premium refund benefit |

|

|

|

Renewal |

|

|

|

Policy term |

10 years |

To age 86 (age next birthday) |

|

Premium payment term |

Single premium/3 years |

To age 86 (age next birthday) |

|

Premium |

Higher |

Lower |

|

Monthly premium^

|

Age of 25: HKD 362 |

Age of 25: HKD 6 |

^For the No Claim Refundable Premium Option, it assumes the premium payment term is 3 years, while the Non-Refundable Premium Option assumes a yearly premium renewable term. All premiums are excluded levy and are rounded to the nearest whole number.

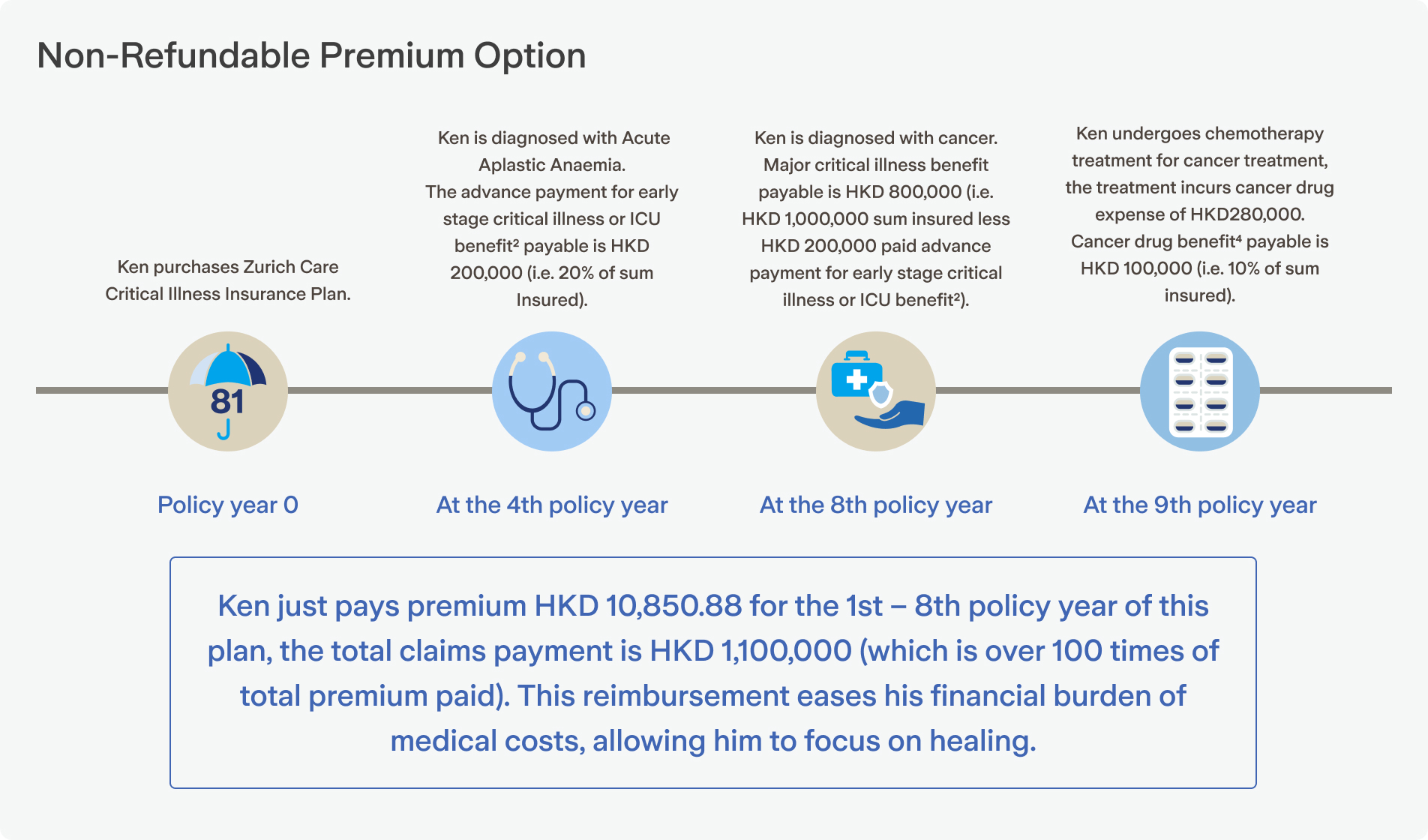

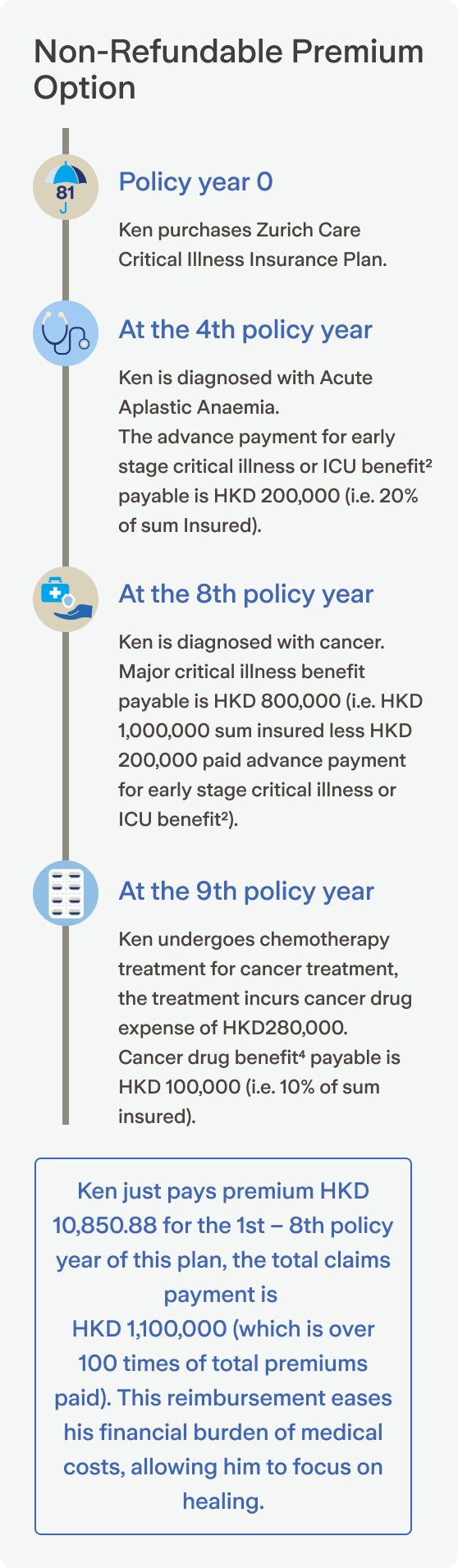

How does the plan works?

Product summary table

Basic Information

Premium payment term

Policy term

Premium renewable term

Premium payment frequency

Minimum sum insured (per policy)

Maximum sum insured (per product)

19-55 (age next birthday): HKD 1,500,000

56-60 (age next birthday): HKD 1,000,000

61-66 (age next birthday): HKD 500,000

Issue age

Policy currency

Waiting period

Residency

Benefit

Premium refund benefit

100% of total premiums paid will be refunded to policyholder if no claim has been made as at policy maturity (end of the 10th policy year)

Death benefit

Major critical illness benefit

- Cover 71 major critical illnesses

- 100% of sum insured minus advance payment for early stage critical illness benefit or ICU benefit2 and any outstanding premium

- The policy will be automatically terminated when this benefit is payable (except the life insured had confirmed diagnosis of cancer)

Advance payment for early stage critical illness benefit or ICU benefit2

- Cover 10 early stage critical illnesses and ICU benefit2

- 20% of sum insured (maximum limit of HKD 300,000)

- Only one settlement of claim can be made under this benefit throughout the policy term

Cancer drug benefit4

- Cover cancer drug4 expenses within 24 months after the first confirmed diagnosis of cancer

- 10% of sum insured (maximum limit of HKD 120,000)

- The cancer drug must be listed under the latest Hospital Authority Drug Formulary List of Malignant Disease and Immunosuppression

Policy services

Renewal

Change of sum insured

Premium structure

Premium

- The premium is guaranteed unchanged throughout the premium payment term

- The premium is fixed within the first premium renewal term and may be revised after the first premium renewable term.

- Premium rate will depend on age, gender, smoking status, health conditions and premium renewable term or other factors (please see “Premium adjustment” for more details)

FAQ

You may find these helpful

Q1

How is Zurich Care different from other insurance plan?

Q1 answer:

Designed with more flexibility to fit your needs and budget . Zurich Care provides two plan options, No Claim Refundable Premium Option and Non-Refundable Premium Option. Both plan options provide coverage for major critical illness benefits, advance payment for early stage critical illness benefits or ICU benefit, death benefit and cancer drug benefit. For the No Claim Refundable Premium Option, it provides premium refund benefit if no claim has been made as at policy maturity (end of the 10th policy year).

Q2

What kind of cancers are covered by Zurich Care?

Q2 answer:

Zurich Care covers for any malignant tumor positively diagnosed and any occurrence of histologically confirmed leukemia, lymphoma or sarcoma. Except for Tumor of the Thyroid (at TNM classification T1N0M0 or a lower stage); Tumor of the Prostate (at TNM classification T1a or T1b or T1c or a lower stage); Chronic Lymphocytic Leukaemia classified as less than RAI stage III; Skin Cancer (except Malignant Melanoma); any Cancer where HIV infection is also present; and any pre-malignant or non-invasive Cancer or Carcinoma-in-situ , or as having either borderline malignancy or low malignant potential.

Q3

How to entitle a cancer drug benefit?

Q3 answer:

After the confirmed diagnosis of Cancer for the life insured, with a need to receive cancer drug further for the cancer treatment. Such cancer drug must be listed under the latest Hospital Authority Drug Formulary List of Malignant Disease and Immunosuppression.

Q4

What sum insured fits my need?

Q4 answer:

You are free to choose the sum insured according to your protection needs and affordability. You may choose an amount that is able to cover your medical expenses and loss of income during recovery.

Q5

Is there an age limit for applying Zurich Care?

Q5 answer:

Anyone from the age of 1- 66 (age next birthday) can apply for Zurich Care.

Q6

Do I need to undergo a medical examination when applying for Zurich Care?

Q6 answer:

No, you do not need to undergo a medical examination. The applicant only needs to answer a few underwriting questions about their health condition, and the approval result can be obtained in as little as 4 minutes. Apply now!

Q7

How many ways do you accept payments?

Q7 answer:

We accept VISA and Master Credit card auto-pay (CCA) for both initial and renewal premium(s). Any incurred credit card fee for all initial and renewal premium(s) should be absorbed in pricing. After policy issue, in case of CCA failure for renewal premiums, other existing payment methods should be accepted which is subject to the prevailing administration rules.

Q8

Is the premium guaranteed to remain unchanged throughout the policy term?

Q8 answer:

For the No Claim Refundable Premium Option, the premium shall remain unchanged throughout the policy term. For the Non-Refundable Premium Option, the premium shall remain unchanged until the first premium renewable term.

Q9

Will the insurance plan be renewed automatically if I do not do anything?

Q9 answer:

Yes, Non-Refundable Premium Option will be renewed automatically at the end of each premium renewable term up to the age of 100 (age next birthday) of the life insured without health underwriting. Unless we have been informed in writing of your intention not to renew the policy before the next renewal, the policy will be automatically renewed for another premium renewable term (subject to premium change) at the end of each premium renewable term until the policy expiry date.

Q10

How much will I get back if I cancel my policy?

Q10 answer:

Provided that no claim has been made under your policy, you have the right to cancel it within 21 calendar days immediately following the day of delivery of the cooling-off notice to you. After the cooling-off period, you may request for policy surrender (i.e. policy cancellation), after which the policy will terminate. This policy has no cash value, no amount will be refunded upon policy surrender. For the avoidance of doubt, no benefits and no surrender value shall be paid and no premium shall be refunded if the policy is terminated upon the surrender of the policy.

Q11

How to manage my policy(ies)?

Q11 answer:

You can call our customer care hotline at +852 2968 2288 for queries or you can login to our online platform “One Zurich” to manage your policy(ies) and check policy(ies) information.

Q12

What is the claims procedure for Zurich Care?

Q12 answer:

If you wish to make a claim, you must send us the appropriate claim forms and relevant proof with immediate notice in case of death of the life insured or within 90 days from the date after the diagnosis of critical illness and/or surgery or stayed in Intensive Care Unit (ICU) of a hospital for a consecutive three days or more. You can obtain the appropriate claim form from Zurich website www.zurich.com.hk.

Q13

Is there a waiting period for Zurich Care Critical Illness Plan?

Q13 answer:

Yes, there is 90 days waiting period for both No Claim Refundable Premium Option and Non-Refundable Premium Option. Waiting period applies to major critical illness benefit, advance payment for early stage critical illness benefit or ICU benefit and cancer drug benefit. This means that claimant is not eligible for the benefits within 90 days immediately from the policy issue date, or the policy reinstatement date, whichever is later (except when a critical illness is caused by an accident and the waiting period will not apply).

Q14

Will the claim of advance payment for early stage critical illness benefit or ICU benefit affect the payment of major critical illness benefits, death benefit and cancer drug benefit?

Q14 answer:

Any advance payment for early stage critical illness benefit or ICU benefit will be deducted from major critical illness benefits when major critical illness benefit is payable. The Advance payment will not be deducted from death benefit and cancer drug benefit.

Resources that may help

*Only available in Traditional Chinese